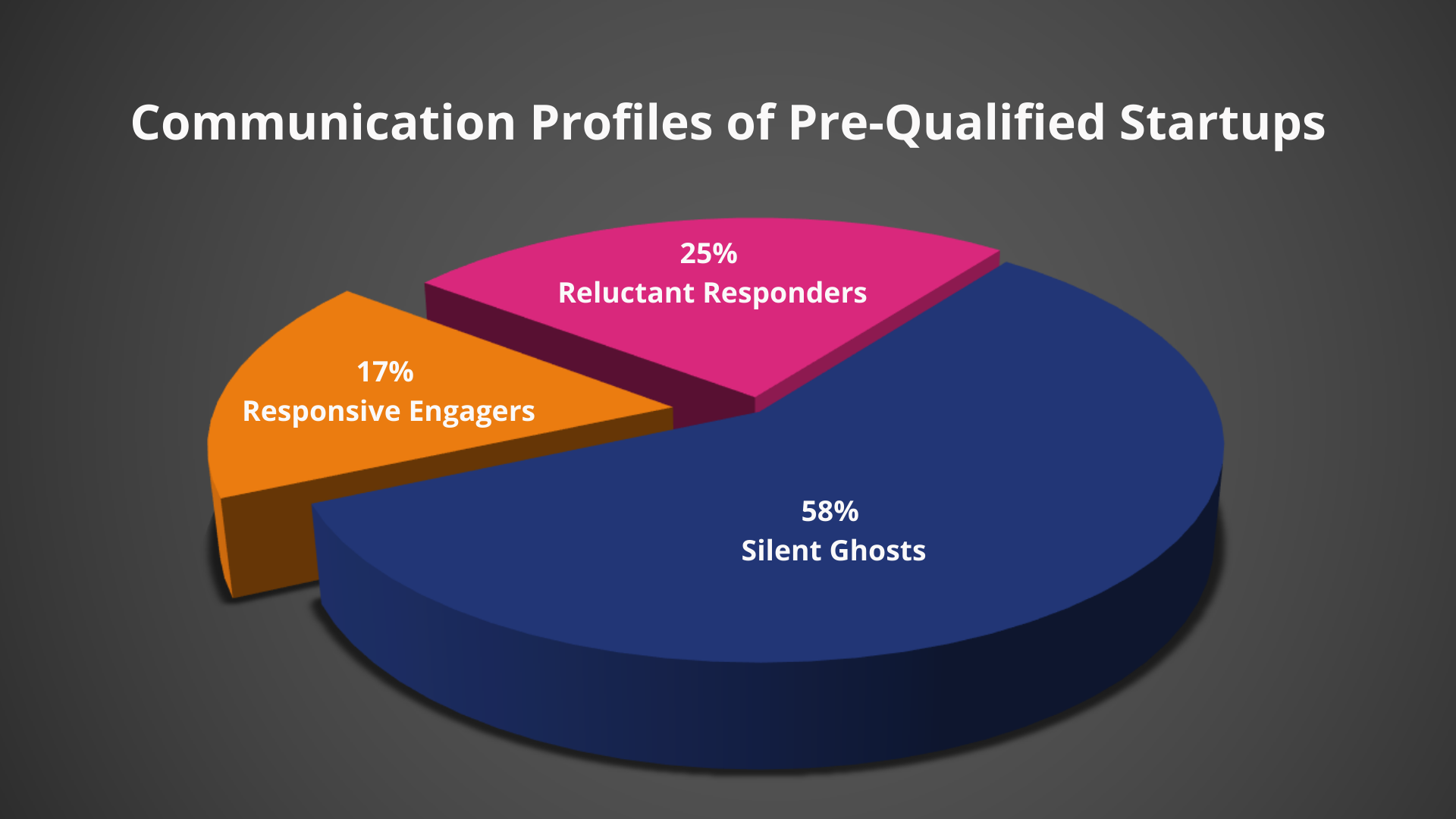

Our analysis of 120 pre-qualified startup teams seeking investment revealed a striking pattern: 83% of founding teams demonstrate communication behaviours that significantly hinder their fundraising potential. This case study examines how founder communication patterns predict fundraising outcomes and what investors should watch for before committing valuable time and resources.

1. Responsive Engagers (17%): Teams that maintained timely, efficient communication throughout the process

2. Reluctant Responders (25%): Teams requiring 2-3 follow-ups to progress to each next step

3. Silent Ghosts (58%): Teams that went completely silent after 2-3 follow-up attempts

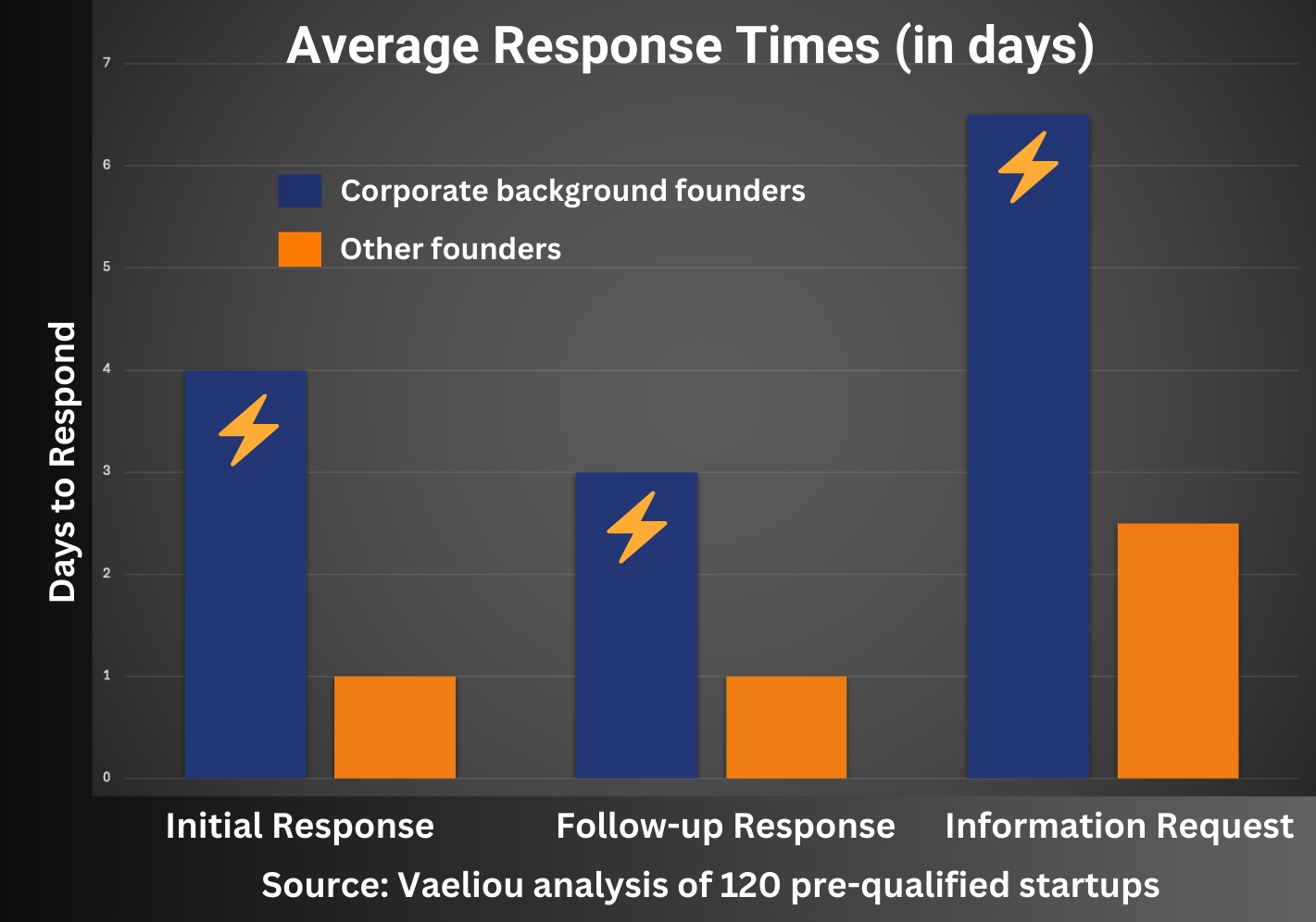

Note: Corporate-background founders required multiple reminders to achieve the response times shown above. In contrast, other founders typically responded without prompting. This suggests the response gap is even more significant when considering the additional follow-up efforts required.

Diffused Accountability: Despite establishing a single point of contact, communication responsibility would shift between team members, creating confusion and delays

Excessive Processing Time: Corporate-trained founders often required days or weeks to respond to basic information requests

Incomplete Information Cycles: Information would be provided in fragments, requiring multiple follow-ups to gather a complete picture

1. Time Inefficiency: Chasing unresponsive founders consumes valuable time that could be directed toward responsive teams

2. Opportunity Cost: Delayed or incomplete information postpones investment decisions, potentially missing market opportunities

3. Due Diligence Complications: Communication issues frequently indicate deeper organisational dysfunction

4. Relationship Strain: Investor-founder relationships that begin with communication challenges rarely improve post-investment

Inconsistent response times to critical inquiries

Shifting responsibility among founding team members

Resistance to providing clarifying information

Communication style mismatched with company maturity stage

Disconnect between claimed expertise and communication quality

Want to protect your portfolio from avoidable team-related failures? Send us your high-potential startup prospects for comprehensive founder intelligence beyond what traditional due diligence reveals.