Stop filling out endless questionnaires. Build your investor-ready profile once, connect with vetted investors whose thesis genuinely aligns with your sector, stage, and geography. Your data remains confidential until you choose to engage.

Every investor asks different questions. You're rebuilding your story dozens of times, chasing connections through cold emails, and wondering if you're even talking to the right investors. Meanwhile, sophisticated investors evaluate founder capabilities you're not even showcasing.

92% of investment decisions are based on founder evaluation, yet most founders focus on pitch perfection instead of demonstrating authentic entrepreneurial intelligence. Traditional approaches fail to capture what investors actually need to see: strategic decision-making under pressure, financial acumen, entrepreneurial resilience, and global market foresight.

Join our exclusive webinar to discover how Vaeliou Intelligence connects founders with vetted investors.

How to create a compelling founder profile that investors value

The Vaeliou matching process and what makes it different

How to maximise your visibility with qualified investors

Best practices for fundraising success on our platform

Limited spots available. Complete the form below to reserve your spot. You'll receive a confirmation email with webinar access details 24 hours before the session.

Our AI-driven platform structures your founder intelligence across five strategic pillars that capture what investors genuinely evaluate. Complete your comprehensive profile once—properly—and maintain it with minimal monthly effort whilst connecting with aligned investors continuously.

Before you ever connect with investors, our platform ensures your intelligence meets institutional due diligence expectations. We guide you through the same frameworks sophisticated investors use during evaluation—helping you avoid common pitfalls whilst positioning your capabilities to attract quality investor matches. This upfront diligence preparation means you present confidently, investors engage seriously, and conversations move efficiently toward alignment.

Team Due Diligence - Leadership capabilities, advisory strength, and execution experience

Financial Health - Financial strategy, projections, and demonstrated acumen

Technology Evolution - Product specifications, IP portfolio, and technical roadmap

Legal & Compliance - Regulatory positioning, risk frameworks, and IP protection

Market Opportunity- Market intelligence, competitive positioning, and growth strategy

Our platform connects you with sector-specialist investors based on genuine thesis alignment—not generic platforms where everyone sees everything. We match on sector focus, investment stage, geographical preferences, and specific investment criteria.

What Makes Our Matching Different:

Sector Specialisation - FinTech, HealthTech, EdTech, MilTech and other specialist sectors with dedicated investor networks

Rigorous Curation - Only founders with top due diligence qualify; investors undergo strict verification

Thesis Alignment - Match based on actual investment criteria, not hope

Complete Data Sovereignty - Your information is never sold or shared commercially

You decide when investors see your profile. Your data remains confidential until you choose to engage with specific opportunities. No spam, no unwanted outreach, no compromised negotiations.

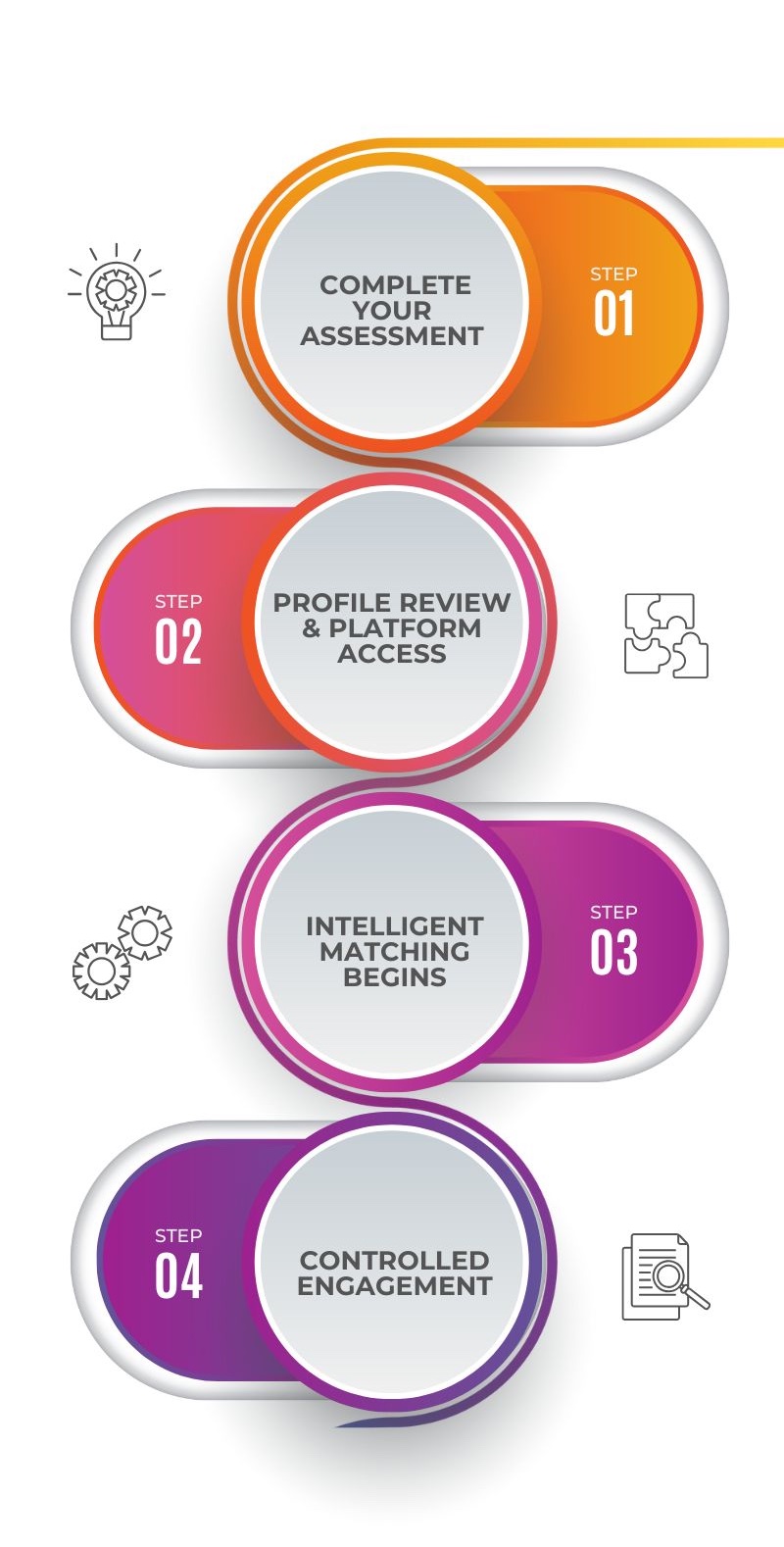

Our AI guides you through sector-specific questions across all five pillars. Smart prompts ensure comprehensive coverage without generic forms. Time investment: 1 hour for initial completion.

Following positive review, your founder profile activates on our platform. Access your personalised dashboard showing real-time intelligence across each pillar and matching algorithm status.

Our platform continuously matches your profile against vetted investor criteria in your sector. When alignment occurs, you receive connection opportunities with investors actively seeking your profile.

You decide which connections to accept. When you engage, investors see your comprehensive five-pillar intelligence—not another abbreviated deck.

Our Strategic Positioning Assessment is the cornerstone of Vaeliou's approach and the critical first step in your strategic positioning journey.

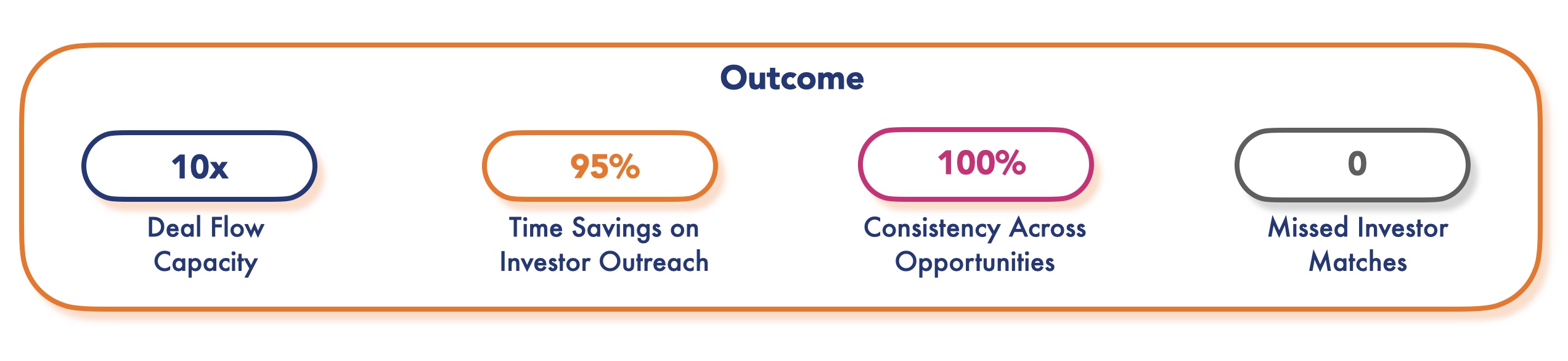

10x Deal Flow Capacity

One comprehensive profile replaces dozens of investor applications. Your intelligence reaches qualified investors continuously without rebuilding presentations for each opportunity.

95% Time Savings on Investor Outreach

Stop researching investors, crafting custom emails, and chasing introductions. Our matching algorithm does the qualification work whilst you focus on building your company.

100% Consistency Across Opportunities

Standardised due diligence documentation ensures every investor receives complete, professional materials, strengthening your credibility and negotiating position throughout.

Zero Missed Investor Matches

Your ready-to-deploy due diligence portfolio means you're always prepared when opportunities arise, never losing momentum or investor interest.

Pre-seed and seed-stage: Companies seeking first institutional investment

Series A preparation: Founders building comprehensive investor pipelines

European startups: Looking to connect with specialist investors

International founders: Seeking European expansion through strategic investment

Sector specialists: In EdTech, FinTech, HealthTech, MilTech and emerging technology sectors

Not Ideal For:

Post-Series B companies

Companies seeking only debt financing

Founders not ready for investor scrutiny

Update financial projections and milestones achieved

Review intelligence across five pillars for currency

Evaluate new investor match opportunities

Engage with connection requests

Updates Available: Immediately after submission

Your profile remains current, your matching stays active, and opportunities flow continuously—all whilst you focus on building your company.

Step 1: Express Interest

Complete our initial intake form (15 minutes). Tell us about your sector, stage, and fundraising objectives. We evaluate platform fit before proceeding.

Step 2: Initial Qualification

Our team reviews your submission against platform standards. We look for sector clarity, stage appropriateness, and fundraising readiness indicators.

Step 3: Platform Invitation

Qualified founders receive platform access to complete the comprehensive five-pillar evaluation. Our AI guides you through sector-specific requirements.

Step 4: Matching Activation

Upon completion, your founder intelligence activates our matching algorithms. You begin receiving investor connection opportunities based on genuine thesis alignment.

Q: How is this different from traditional pitch deck submissions?

A: Traditional decks are static documents that quickly become outdated. Our five-pillar intelligence captures dynamic, comprehensive founder capabilities that investors actually evaluate during due diligence. Your profile updates continuously, and investors see authentic entrepreneurial intelligence - not just polished presentations.

Q: What sectors do you specialise in?

A: We focus on specialist deal rooms including EdTech, FinTech, HealthTech, MilTech and other emerging technology sectors. Each sector includes detailed sub-categories for precise matching with specialist investors.

Q: How do you verify investors?

A: Every investor undergoes strict qualification: active investment thesis verification, portfolio review, sector expertise validation, and investment capacity confirmation. We decline generic platforms where unqualified parties can access your intelligence.

Q: Who sees my information?

A: Nobody until you explicitly choose to engage. Your profile activates matching algorithms, but investors cannot view your detailed intelligence until you accept their connection request. You maintain complete control over information sharing.

Q: Do you sell founder data?

A: Never. Your information is never sold or shared commercially. We operate on subscription and success alignment models—not data monetisation. Complete data sovereignty is fundamental to our platform.

Q: Can I remove my profile?

A: Absolutely. You control your presence entirely. Deactivate temporarily for stealth periods, reactivate when ready, or remove permanently at any time.

Q: How long until I see investor matches?

A: Matching begins immediately upon profile activation. However, quality matches depend on current investor activity in your sector. Most founders see first matches within 2-4 weeks. We prioritise quality alignment over volume.

Q: What if my company pivots?

A: Update your five pillars to reflect new direction. Our AI guides you through relevant changes, and matching algorithms automatically adjust to find newly-aligned investors.

Q: Do I need to be fundraising actively to join?

A: No. Many founders build profiles whilst pre-fundraising to understand investor appetite and refine positioning. Your profile can remain private whilst you develop intelligence, then activate matching when ready.

Q: How many investor connections should I expect?

A: Quality over quantity. We focus on genuine thesis alignment rather than connection volume. Expect 3-6 highly-qualified matches per quarter, depending on your sector and stage.

Q: What does platform access cost?

A: Pricing starts from EUR 150.00 and consists of a due diligence one-time fee and a monthly subscription. Complete your initial assessment to receive pricing information based on your sector and stage. We offer flexible engagement models aligned with early-stage founder constraints.

Q: Is there a long-term contract?

A: No. Month-to-month commitment with cancellation freedom. We believe founders should stay because of the value delivered, not contractual obligation.

Q: Do you guarantee funding?

A: No platform can guarantee investment. We guarantee qualified investor matches based on genuine thesis alignment and a comprehensive founder intelligence presentation. Funding decisions remain between you and investors.

Q: What happens after I connect with an investor?

A: You conduct your fundraising relationship independently. Our platform facilitates introductions and provides your comprehensive intelligence. Negotiations, due diligence, and closing processes remain direct between you and investors.

Q: Can I see success stories?

A: We maintain founder confidentiality throughout fundraising processes. However, during your initial consultation, we can share anonymised outcome data for your specific sector and stage.