Stop managing deal flow through fragmented spreadsheets, email threads, and generic CRM systems. Deploy a white-labelled intelligence platform that evaluates startup candidates against your specific investment thesis—whilst maintaining complete confidentiality and institutional control.

Your investment committee reviews dozens of opportunities monthly. Each startup arrives with different documentation quality, incomplete financials, and varying levels of due diligence preparation. Your team wastes 60-80 hours per deal reconstructing basic intelligence before proper evaluation even begins.

The institutional reality: 73% of VC partner time goes to deal administration rather than strategic evaluation. Your competitive advantage isn't seeing more deals—it's evaluating the right deals faster and more comprehensively than competitors.

Deploy a white-labelled platform that reflects your fund's identity whilst capturing structured founder intelligence across five strategic pillars. Startups you invite complete comprehensive assessments tailored to your Investment Blueprint—delivering institutional-grade due diligence before your team invests evaluation time.

We translate your investment thesis into intelligent evaluation frameworks. Your dealroom automatically scores startup candidates against your specific criteria: sector focus, stage requirements, geographical preferences, team composition standards, financial metrics thresholds, and strategic positioning factors.

What makes your Investment Blueprint different:

Thesis Precision - Evaluation criteria match your actual investment decisions, not generic scoring

Sector Customisation - FinTech, HealthTech, MilTech or emerging technology frameworks tailored to your focus

Stage Calibration - Assessment depth scales appropriately for pre-seed through Series A evaluation

Geographic Intelligence - Market context relevant to your investment geography and expansion priorities

Team Dynamics - Leadership capability assessment aligned with your partnership requirements

Team Due Diligence - Leadership capabilities, advisory strength, execution experience, and founder complementarity

Financial Health - Financial strategy, projection methodology, unit economics, and demonstrated commercial acumen

Technology Evaluation - Product specifications, technical roadmap, IP portfolio, and development capability

Legal & Compliance - Regulatory positioning, risk frameworks, IP protection, compliance understanding and readiness

Market Opprtunity - Market intelligence, competitive positioning, go-to-market strategy, and growth model validation

Before startups ever reach your pipeline, our platform ensures intelligence meets institutional evaluation requirements. Founders complete the same frameworks your investment committee uses during assessment—eliminating the 60-80 hours your team typically spends reconstructing basic information.

Your due diligence advantage:

Consistent evaluation standards across all opportunities

Complete financial model transparency and projection methodology

Verified team credentials and advisory relationships

Documented IP positioning and regulatory compliance status

Comparable intelligence across competing opportunities

Your investment committee, analysts, and sector specialists access centralised intelligence simultaneously. Internal notes, scoring, and evaluation progress remain confidential to your organisation whilst founders see only standardised communication.

Collaboration capabilities:

Multi-user access with customisable permission levels

Internal scoring and evaluation tracking invisible to founders

Centralised communication history across your entire team

Pipeline management dashboards showing deal flow status

Automated reminders for evaluation milestones and founder follow-ups

Your deal flow remains entirely proprietary. Startups you invite see only your branded platform—never Vaeliou's network or other investors' activity. Your Investment Blueprint, evaluation criteria, and pipeline composition stay completely confidential.

Privacy architecture:

White-labelled platform maintains your brand throughout founder experience

Zero cross-contamination with other investors' deal flow

Startup candidates cannot see other opportunities in your pipeline

Your investment thesis and scoring criteria remain invisible to founders

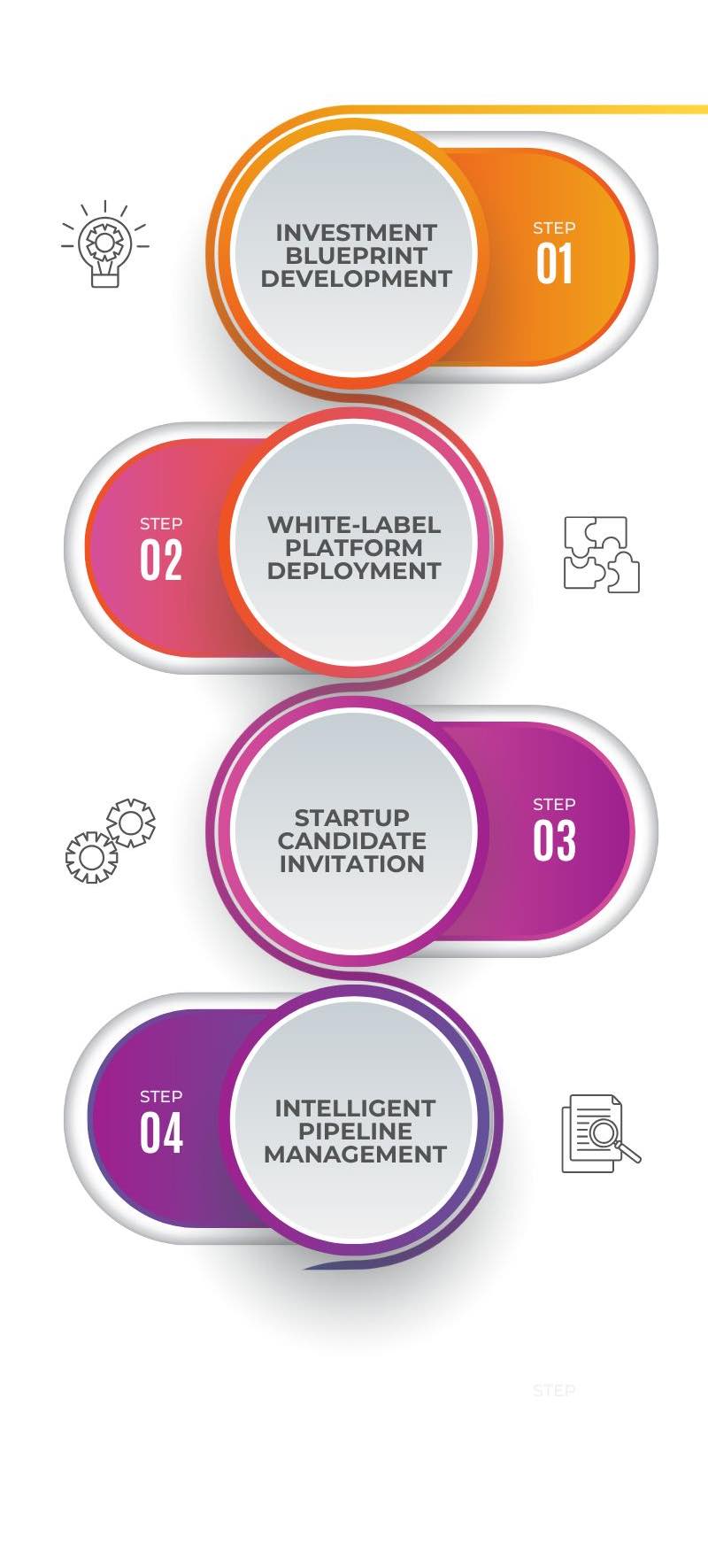

Investment Blueprint Development

Custom Investment Blueprint configuring your dealroom's assessment criteria, scoring algorithms, and intelligence requirements.

White-Label Platform Deployment

Fully operational white-labelled platform with your branding, custom assessment frameworks, and team collaboration infrastructure.

Startup Candidate Invitation

Professional, branded assessment process demonstrating your institutional sophistication whilst capturing the intelligence your committee actually needs.

Intelligent Pipeline Management

Consistent, comprehensive, comparable intelligence enabling faster decision-making and higher-quality deal assessment.

Process significantly more opportunities without proportional team expansion. Structured intelligence and automated scoring enable your existing team to evaluate broader pipeline whilst maintaining quality standards.

Automated scoring against your Investment Blueprint immediately surfaces thesis-aligned opportunities. Your team focuses evaluation time on strategically relevant candidates rather than administrative sorting.

Complete confidentiality protection. Your deal flow, Investment Blueprint, and evaluation criteria remain entirely proprietary—giving you sustained competitive advantage in your sector.

Every opportunity is evaluated through identical frameworks. No more comparing incomplete startup information - your committee sees comparable intelligence enabling confident decision-making.

We've increased due diligence efficiency by 60% whilst improving investment quality." — Managing Director, Eschenburg Ventures

Vaeliou's founder intelligence helped us identify red flags in a Series A opportunity that saved us from a £2M mistake." — Partner, London-based VC Fund

Venture Capital Firms: Early-stage and growth funds seeking consistent deal evaluation and team collaboration efficiency

Angel Networks: Organised syndicates requiring standardised assessment across diverse membership

Corporate Venture Arms: Strategic investors evaluating alignment with parent company objectives and integration requirements

Family Offices: Sophisticated investors maintaining institutional standards with lean investment teams

Sector-Specialist Funds: FinTech, HealthTech, MilTech, and emerging technology investors requiring deep domain evaluation

Individual angel investors (see Vaeliou Intelligence for Investors)

Post-Series B growth equity (different evaluation requirements)

Debt-only investment strategies

Passive investment vehicles without active evaluation processes

Discuss your investment thesis, deal flow volume, current evaluation challenges, and organisational requirements. We assess platform fit and outline potential Investment Blueprint configuration.

2-3 facilitated sessions

Our team works directly with your investment committee to translate your thesis into structured evaluation frameworks. We capture the criteria that drive your actual investment decisions—not generic scoring models.

White-label customisation and team onboarding

Your branded dealroom deploys with custom Investment Blueprint integration. Your team receives comprehensive training, ensuring a smooth launch and immediate operational capability.

Invite startup candidates

Begin inviting opportunities to complete the assessment through your dealroom. We provide ongoing support through initial deals whilst you optimise workflows and refine evaluation processes.

Q: How is this different from CRM systems or deal management tools?

A: Traditional CRM systems track communication and relationships but don't capture structured founder intelligence. Deal management tools organise your pipeline but don't evaluate candidates against your Investment Blueprint. Our platform combines both—structured intelligence capture tailored to your thesis with pipeline management and team collaboration—whilst maintaining complete white-label confidentiality.

Q: What sectors can you support with custom Investment Blueprints?

A: We specialise in technology-enabled sectors, including FinTech, HealthTech, EdTech, MilTech, and emerging technology domains. Our framework methodology adapts to your specific sector focus—whether specialist or generalist thesis. During blueprint development, we translate your unique investment criteria into structured evaluation frameworks regardless of sector.

Q: Can we integrate with our existing systems?

A: Yes. We provide integration with your existing CRM, email systems, and reporting infrastructure. Most organisations run our dealroom as their primary evaluation platform whilst syncing pipeline status to existing management systems.

Q: How many team members can access our dealroom?

A: Unlimited users within your organisation. Investment committee members, analysts, sector specialists, and administrative staff all receive appropriate access levels. Pricing is based on deal flow volume and platform features—not user count.

Q: How long does Investment Blueprint development take?

A: Typically 2-3 weeks, including facilitated workshops with your investment committee, framework documentation, platform configuration, and validation testing. Timeline depends on thesis complexity and committee availability for workshop sessions.

Q: Can we modify our Investment Blueprint after launch?

A: Absolutely. Your thesis evolves as markets change and portfolio insights accumulate. We recommend quarterly blueprint reviews to ensure evaluation criteria remain aligned with current strategic priorities. Updates deploy immediately across your platform.

Q: Do startups see our Investment Blueprint criteria?

A: Never. Founders see assessment questions tailored to your requirements but never your scoring algorithms, evaluation thresholds, or strategic priorities. Your Investment Blueprint remains completely confidential to your organisation.

Q: How does automated scoring work?

A: As startups complete assessment, our platform evaluates responses against your Investment Blueprint criteria. You receive compatibility scores highlighting thesis alignment across sectors, stage, geography, team composition, and strategic factors. Scoring surfaces promising opportunities whilst your team maintains final evaluation authority.

Q: Do startups know they're using Vaeliou's platform?

A: Only if you choose to disclose it. The platform is entirely white-labelled with your branding, domain, and communication. Founders experience a professional assessment process from your organisation—our infrastructure remains invisible unless you prefer transparency.

Q: Can competing investors see our deal flow?

A: Never. Your dealroom is completely isolated. Startups you invite cannot see other investors, your pipeline remains proprietary, and zero information sharing occurs across different organisations' platforms. Complete confidentiality protection is fundamental to our architecture.

Q: What happens if we stop using the platform?

A: You receive complete data export of all startup assessments, evaluation history, and pipeline intelligence. Your Investment Blueprint documentation remains your property. We recommend archive access for historical reference, but you retain full data sovereignty regardless of platform status.

Q: Can we customise assessment questions?

A: Yes, within framework structure. During Investment Blueprint development, we incorporate your specific evaluation priorities and sector requirements into assessment questions. Core five-pillar architecture ensures comprehensive intelligence whilst questions reflect your unique investment criteria.

Q: What if startups don't complete the due diligence?

A: Incomplete assessments signal founder commitment and organisational capability. Startups serious about institutional investment allocate time for proper evaluation. Your dealroom tracks completion progress and sends automated reminders, but founders who cannot complete a structured assessment typically lack the discipline for successful institutional partnership.